Current legislation favors foreign industries over a sector that generates about 2.9 million direct and indirect jobs in Brazil; ABIMDE promotes mobilization in favor of voting the proposal in the House

ABIMDE (Brazilian Association of Defense and Security Industries) has intensified actions to articulate efforts in favor of voting the PLP (Complementary Law Project) 244/20, in an urgent regime, in the House of Representatives.

The proposal establishes tax exemption for products and services acquired by the Defense and Public Security Forces. Despite its importance for the national economy and for the BIDS (Defense and Security Industrial Base), the proposal is stalled in Congress and there is no expected date to be voted on.

The PLP 244/20 was authored by Congressman Luiz Philippe de Orleans e Bragança. The isonomy would guarantee to national companies the same tax treatment given to foreign companies that sell defense and public security material to Brazil, which today are exempted from several taxes and have advantages in bids held by the Armed Forces and public security agencies, such as state police forces.

Aiming to reestablish the constitutional principle of isonomy, ABIMDE has been talking to business leaders to articulate a joint effort to sensitize parliamentarians about the need to deal with the PLP 244/20 under the Urgency Regime.

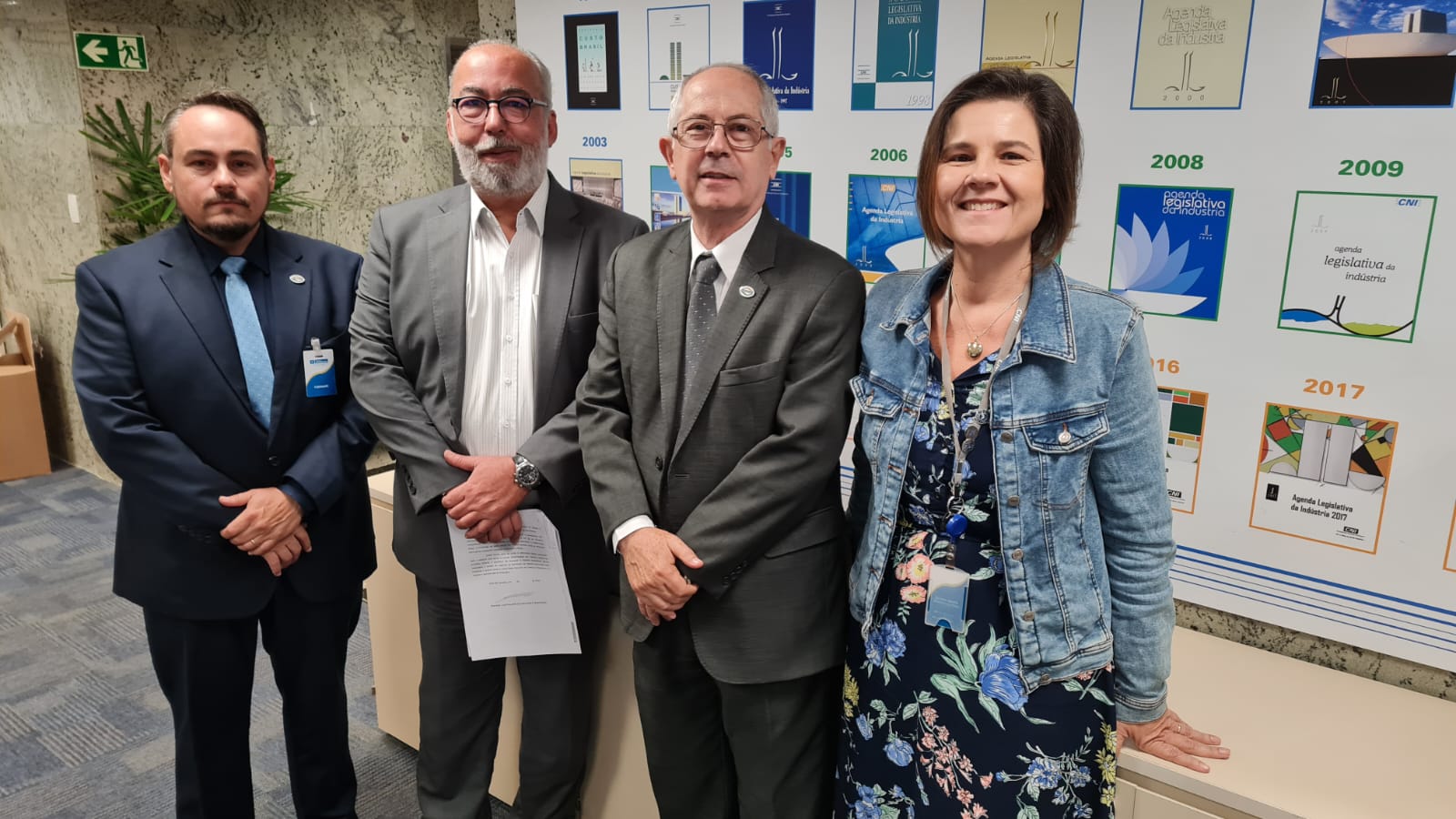

Achieving this goal is among the priorities of General Aderico Mattioli, who took over as Executive President of ABIMDE on May 10 and in the same week met with representatives of the CNI (National Confederation of Industry) to discuss the matter. The meeting was attended by Marcos Borges, Suzana Squeff Peixoto Silveira and Fabiano Lima Pereira, from the Legislative Affairs Management of CNI, and Rogério Beltrão, Director of ABIMDE.

For General Mattioli, congressmen and society need to understand that what is being sought is not ‘tax exemption’, but equal conditions between national and foreign companies in public bids for defense and public security products. He points out that the sector’s industries employ around 2.9 million people directly and indirectly, and represent more than 4.5% of the GDP (Gross Domestic Product).

“Besides being unconstitutional, this competitive imbalance is a barrier to new investments and job creation. This situation causes a strong negative impact in an extremely strategic sector for the country, which is a great risk to national sovereignty,” said General Mattioli. For Suzana Silveira, the issue really needs to be debated.

“Our understanding is that there is this difference in taxation between domestic purchases and imports, and the sector is strategic for the country.” The Brazilian legislation in force gives advantages to international Defense and Security companies, because they benefit from tax immunity that makes their products more competitive.

“The enormous tax burden that falls on national defense and public security products does not fall on imported products. This situation creates the false perception that the national products would be expensive and bad, because these taxes are embedded in the sale price, but, in fact, our Defense and Security Industry is very competitive, presenting successive records of exports, being internationally recognized for its products of extreme quality and fair prices,” said Rogério Beltrão.

“The PLP 244/2020 aims to ensure isonomy of competition by simply changing the wording of existing infra-constitutional provisions,” concludes the director.

Photo caption: From left, Rogério Beltrão, Director of ABIMDE, Marcos Borges de Castro, Executive Manager of Legislative Affairs at CNI, General Aderico Mattioli, Executive President of ABIMDE, and Suzana Squeff Peixoto Silveira, from CNI’s Legislative Monitoring Unit. Photo Credit: Divulgação/ABIMDE *** Translated by Defconpress team ***