The manufacturer delivered the first freighter, also known as the KC-390, four years ago, but until 2022 purchases were a trickle

(DEFESANet) Four years after delivering the first C-390 Millennium military cargo plane to the Brazilian Air Force (FAB), Embraer is finally seeing concrete progress in marketing the largest aircraft it has ever developed to other countries. Until 2022, the company had only signed contracts with Portugal (in 2019), Hungary (2020) and the Netherlands (2022). On the other hand, last year alone, it signed deals with Austria, the Czech Republic and South Korea. There are also talks with Saudi Arabia and India.

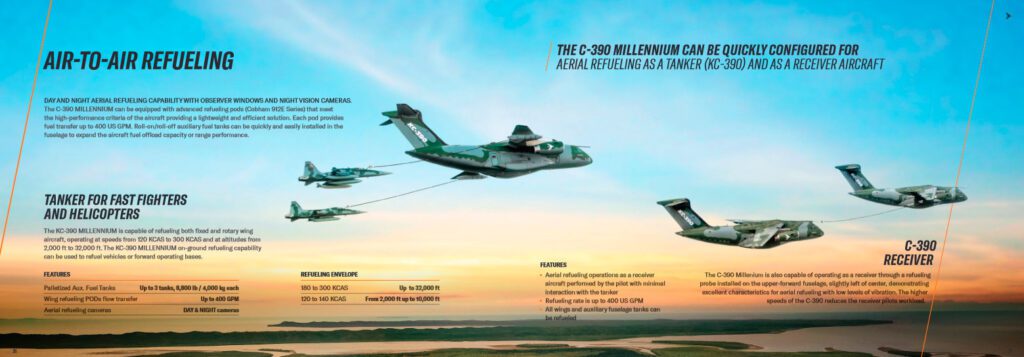

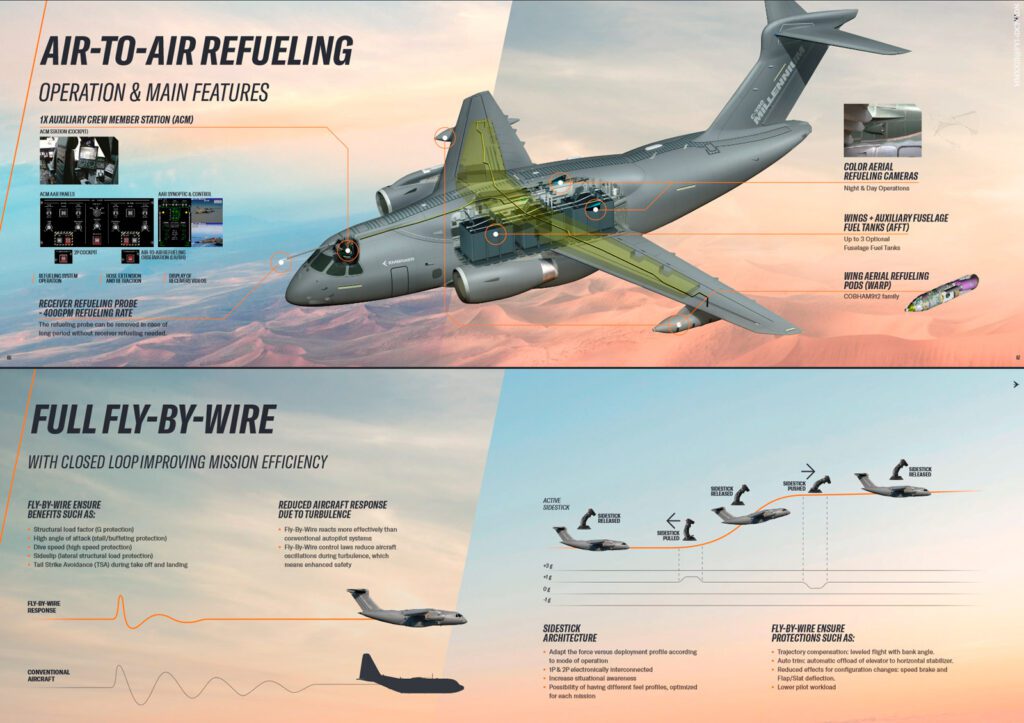

Announced in 2009, the C-390 program cost US$ 4.5 billion (approximately R$ 22 billion) and was developed in partnership with the FAB. Despite impressing with its technical quality, the plane – which is called the KC-390 when it has the option of refueling in mid-flight – had been disappointing the financial market in terms of sales.

Now, however, there is a positive expectation with the possibility that orders, which have already become more frequent, will gain volume. In India, for example, Embraer is competing to sell 40 to 80 planes. At the moment, the Brazilian company is negotiating a local partner to be its representative in the country – a requirement set by the Indian government.

Negotiations are also underway with Saudi Arabia, where a fleet of 60 aircraft needs to be retired (23 of which have the profile to be replaced by the C-390). In order to sell to the country, Embraer may have to establish a final assembly line for the aircraft there or transfer maintenance, training and parts manufacturing activities.

These requirements are common in sales of equipment to armed forces. Another difficulty is market restrictions. If Embraer wanted to sell, for example, a freighter to Israel, its aircraft could not have any parts manufactured in a country considered an enemy of Jerusalem. Today, the Brazilian company’s market is made up of countries aligned with the United States.

According to Alberto Valerio, an analyst at UBS BB, the company has made progress in political negotiations and in adapting its planes to the demands of governments. This is a lengthy process, he adds, but it is now having an effect.

According to Alberto Valerio, an analyst at UBS BB, the company has made progress in political negotiations and in adapting its planes to the demands of governments. This process is time-consuming, he adds, but it is now having an effect.

The company has also strengthened its defense sales team abroad. The president of Embraer Defense & Security, João Bosco Costa Jr, who took office just over a year ago, established a sales director in Europe and expanded the team that reports to this professional, with employees in South Korea, Saudi Arabia and the Netherlands. Before that, defense sales were concentrated in Brazil.

The restructuring of the sales team replaces the model that was envisaged for Embraer Defense before the pandemic. Until early 2020, when the agreement to sell Embraer’s commercial aviation division to Boeing was in place, the idea was that a joint venture (JV) formed by the two companies, but with Brazilian control, would be responsible for marketing the C-390.

This JV would set up an assembly line in the USA, which would allow direct sales to the American government. For Embraer to sell a military aircraft to the US today, it needs an American company doing the negotiating.

With the new sales team, Bosco Costa Jr. hopes to increase the pace of sales. “We have very positive prospects for the C-390. We have high expectations that new operators will choose the model in 2024 and 2025. We’re imagining a better 2024 than 2023″ (read more here).

The sale of a greater volume of freighters is important for diluting fixed production costs and increasing the margin in Embraer’s defense area, which could increase the company’s value on the stock exchange, according to market analysts.

Today, the defense segment is the company’s smallest, accounting for just 9.6% of net revenues in the first nine months of 2023. In the same period of 2014, when it reached its best moment in 20 years, this figure reached 26%.

By 2022, stock analysts were celebrating the fact that, with the C-390 ready, Embraer’s defense division had at least stopped generating expenses for the company. With cost revisions and an accident involving one of the prototypes, the project had previously worried investors, and the expectation was that the division would have a smaller and smaller stake in the company.

“We still see little value in the defense area, but if you asked me last year what the expectations were for the segment, I would say that it was difficult for the company to achieve anything. Today, I think that, although it’s difficult, it could happen,” says Alberto Valerio.

According to him, there had been great expectation surrounding the C-390 since the plane began to be developed, and orders for dozens of units were expected to be placed. What we saw, however, were timid orders. Portugal bought five freighters and Hungary two. The Netherlands, Austria and the Czech Republic selected the model to buy five, four and two planes respectively. “What we saw were crumbs,” says Valerio.

In Brazil, there was also a big disappointment. In 2021, the Air Force unilaterally decided, on the grounds of budget restrictions, to reduce its order from 28 to 15 freighters. After months of negotiations, it was agreed that there would be 19 units – despite the contract stipulating that the value of the order could be reduced by a maximum of 25%, which meant the sale of 21 units.

The company’s calculations, however, still indicate that, over the next 20 years, 490 freighters will have to be replaced worldwide, a market worth US$ 60 billion (almost R$ 300 billion) in which the C-390 can excel.

*** Translated by DEFCONPress FYI Team ***